News of the struggling property development giant Evergrande has been a key topic of conversation among economists and investors alike. But what if these events could trigger a valuable buying opportunity?

As one of the world’s most indebted companies, owing more than $US300 billion ($400 billion) in various forms, there is much debate as to whether a collapse of Evergrande is possible, and what it might mean for Australia.

In China, the property sector makes up about 25% of gross domestic product (GDP). China also has the world’s second largest economy. So, what happens with Evergrande could certainly have flow-on effects to other countries and economies around the world.

But for now, what could all this mean for Australia and the property market?

The early 2020’s have already wrought more economic drama than most of us have seen in our lifetimes. But despite a country burnt by fires, and the challenges of the global pandemic, Australia’s property market has just recorded its fastest growth in over 30 years.

Think back to 2008 when economies across the globe were feeling the effects of the Global Financial Crisis (GFC). Despite this, the years that followed were some of the best we’ve seen for Australian property.

In fact the GFC was when Freedom Property Investors co-Founder, Lianna Pan, made her first purchase. This initial investment, during such an uncertain time, ultimately resulted in Lianna being able to build a profitable portfolio of over 30 properties today.

Given the inherent strength and resilience of the Australian property market, global events that cause short term price drops can often provide a good opportunity to investors.

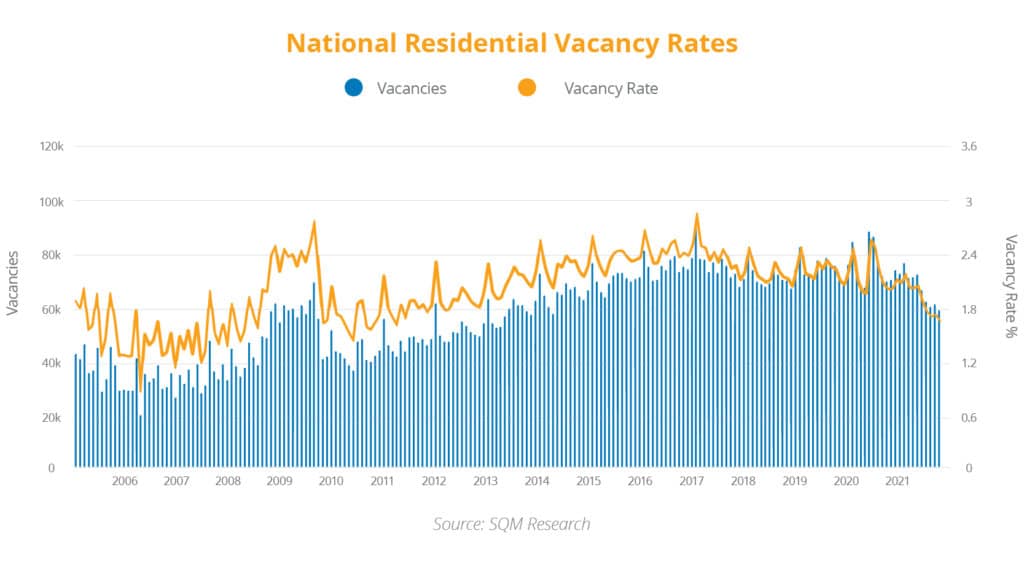

Even without any overseas migration since early 2020, our national vacancy rates are currently sitting at 10-year lows.

Low vacancy rates indicate high demand as well as lack of stock.

What makes our housing market resilient is our persistent state of undersupply across most of the country. This means we haven’t enough stock to meet demand for housing. In turn, putting upward pressure on prices and downward pressure on vacancy rates.

For those investing in property, the situation with Evergrande could potentially reveal a valuable buying opportunity. A short term drop in house prices could be a possible flow-on effect that would offer investors the opportunity to buy property at below fair-market value.

Residential property is known as one of the safest investment options, and is the sole strategy of many successful investors that know how to capitalise on it.

At Freedom Property Investors, we’ve spent the last decade successfully pinpointing boom suburbs and investment hotspots before the rest of the market.

Our unique approach to property investing is backed by a team of researchers and data scientists who identify key growth opportunities for our members. Together, we’ve helped over 4,000 everyday Australians start their journey towards financial freedom through property.

To find out more about what’s impacting the current property market and what you can expect in the months ahead, attend our free online property investor Masterclass.

This is no ordinary online event.

Here we cover the exact steps of how to pick a winning investment property, as well as the hotspot locations where we are currently buying. We’ll show you how to invest safely in property, generating passive income to retire sooner in any economic climate.

– Scott Kuru & Lianna Pan