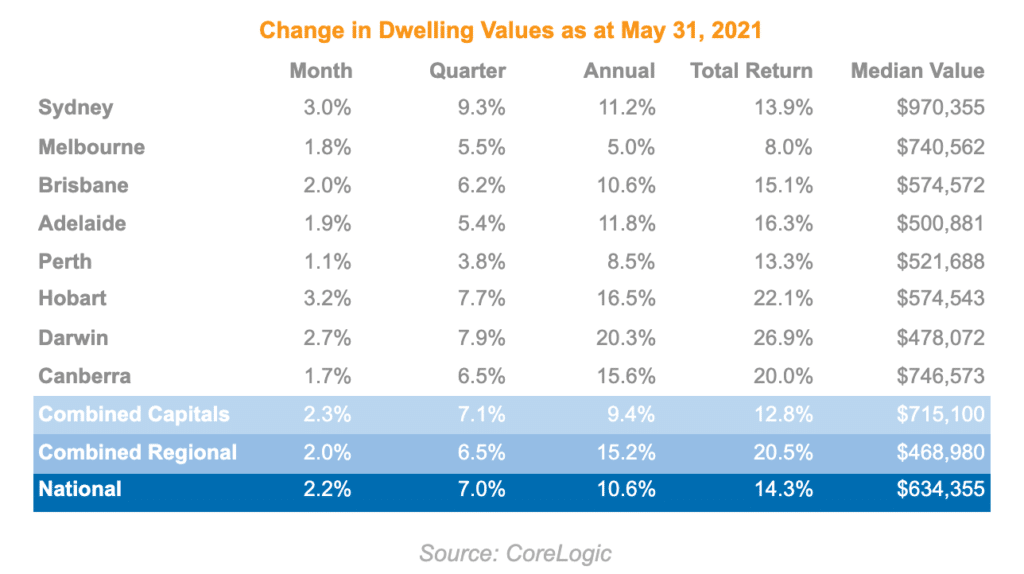

The Australian housing market recorded another price surge of 2.2% in May.

Following a 32-year record in March of 2.8%, and a slightly slower month in April of 1.8%, the strong result in May indicates that the housing boom may not be ready to slow down yet.

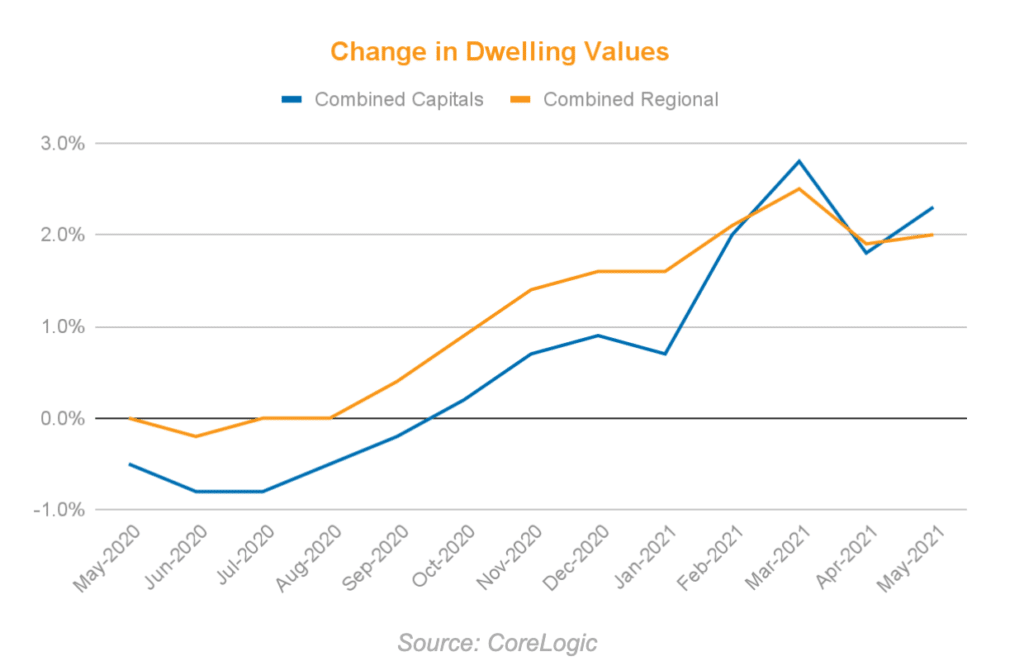

The May result also showed that capital city markets are continuing the short-term trend of out-performing regional markets, with the combined capital dwelling values growing by 2.3% in May, compared with the 2.0% growth of the combined regional markets.

Throughout the pandemic of 2020, regional markets recorded strong growth due to a surge in demand from the significant internal migration out of the metropolitan areas into the regions. However, the data from May suggests that property in the capital cities is still in strong demand.

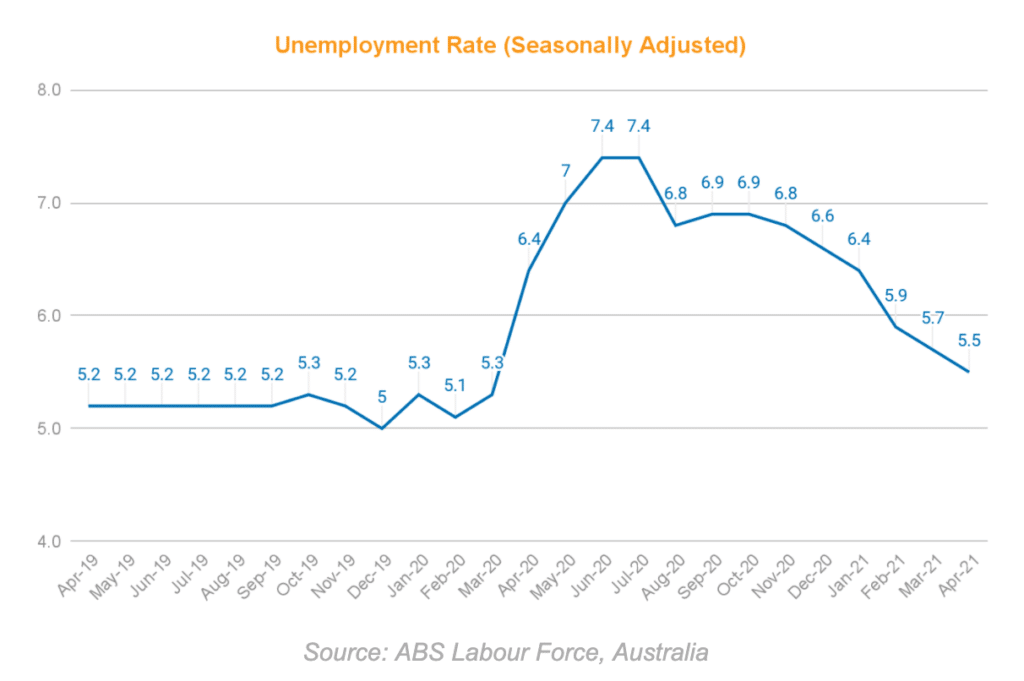

It would also appear that the end of JobKeeper on 31st of March has had little impact on the housing market. Early estimates by the Treasury at the start of the pandemic projected that between 100,000 to 150,000 workers would lose their jobs when JobKeeper ended, however, recent preliminary information released by the Treasury showed that in the four weeks following the end of JobKeeper, only around 56,000 workers lost employment.

This outcome is supported by the ABS data for the unemployment rate, which showed that the end of JobKeeper did not have a discernible impact on employment between March and April 2021, where the rate dropped to 5.5% and is trending downwards towards the pre-COVID rate.

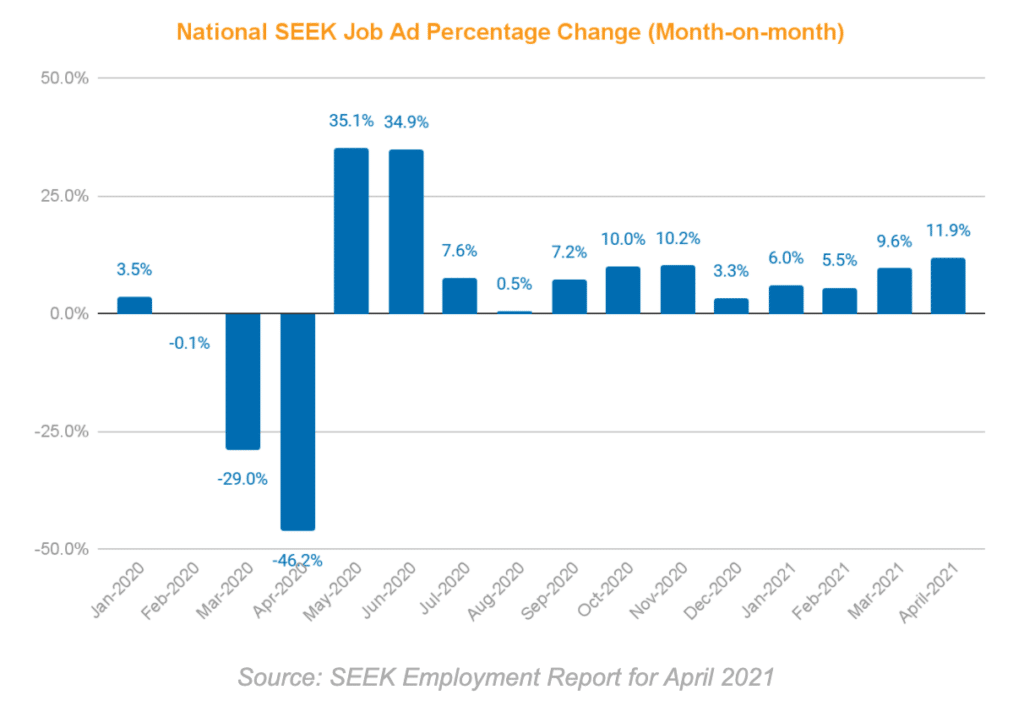

Likewise, in the latest SEEK Employment Report, April was the second consecutive record-breaking month of job ads posted in SEEK’s 23-year history. New job ads on seek.com.au also increased by 11.9% month-on-month in April 2021.

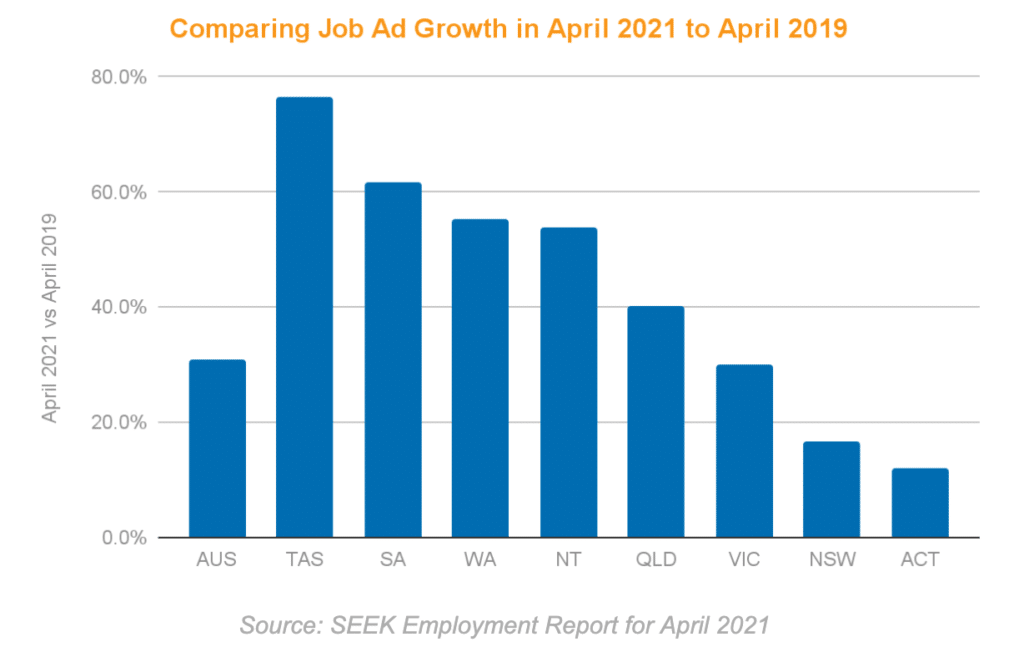

From a year-on-year perspective, comparing April 2021 to April 2020 is not very meaningful given the large slump in job ads placed during the early pandemic crisis in the first half of 2020.

Instead, if we compare SEEK job ads in April 2021 to that of April 2019, we can see that the growth rate was 30.9% higher this year than it was at the same time in 2019, indicating that the job market is in a healthy condition.

On 1st June, the RBA announced its decision to maintain the official cash rate at 0.1%. In its announcement, the RBA governor said that “the economic recovery in Australia is stronger than earlier expected and is forecast to continue” and that “a further decline in the unemployment rate to around 5 per cent is expected by the end of the year”.

In order to support a return to full employment in Australia, the RBA plans to maintain their “highly supportive monetary conditions” and said that they do not plan to increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. This they say is unlikely to be until 2024 at the earliest.

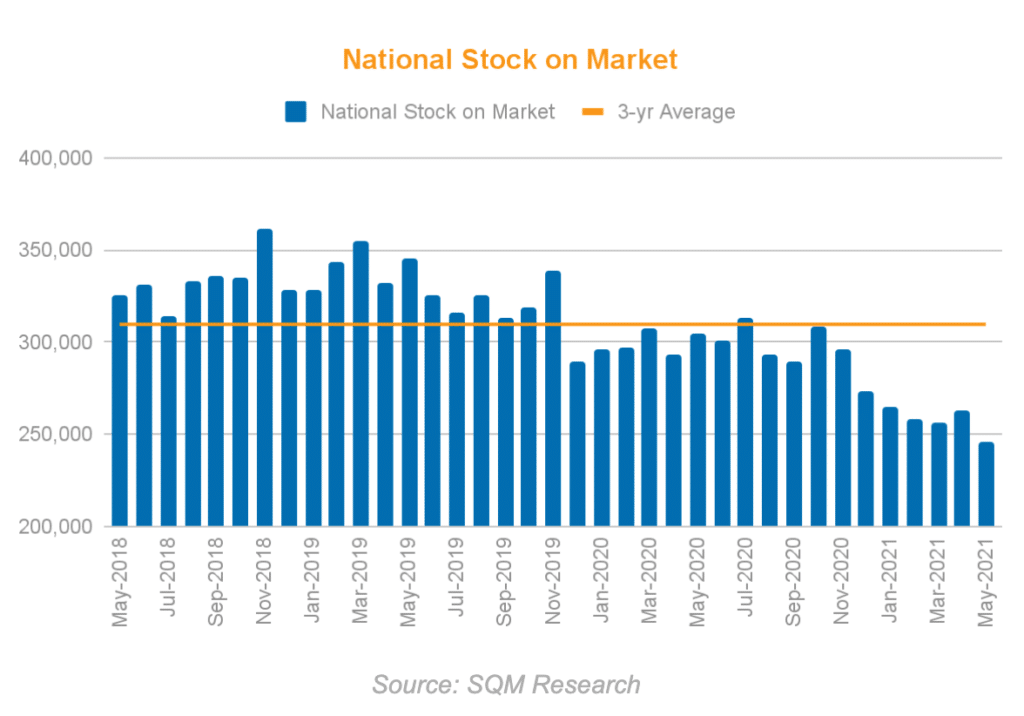

Improving economic conditions along with low-interest rates will provide continued tailwinds for those holding investment properties, who can expect further growth in the near future. Market indicators also point to further upward pressure on house prices, with national stock levels continuing to fall to levels well below the 3-yr average.

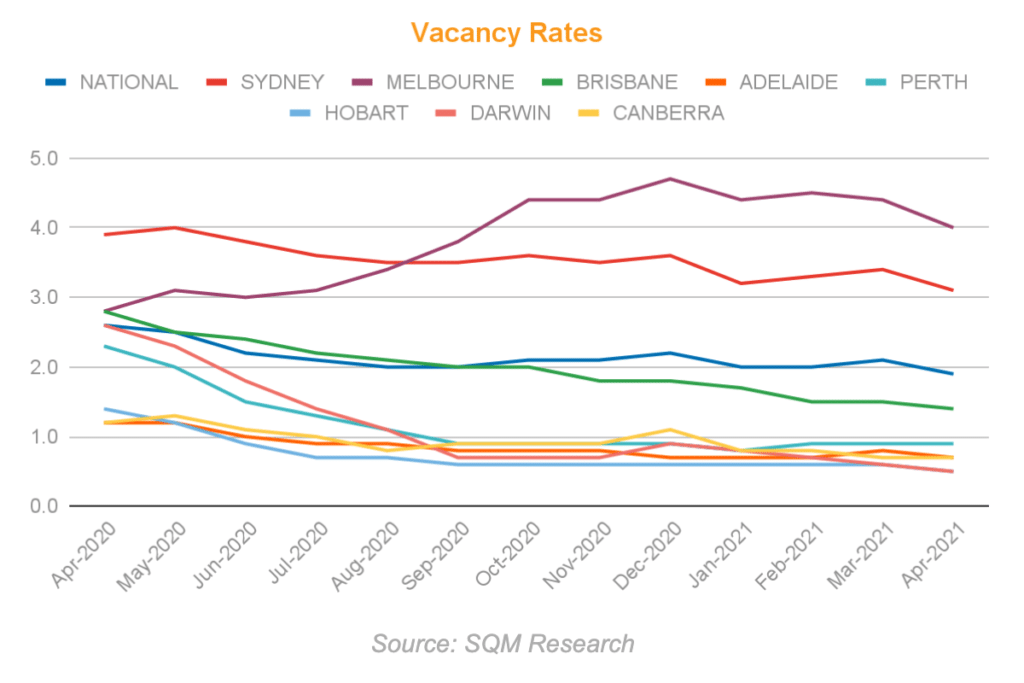

Vacancy rates also point to a dwindling supply of rental housing, with the national vacancy rate falling to 1.9% (a level not seen since March 2013). Additionally, many States and Territories, including Perth, Adelaide, and Canberra are now showing vacancy rates below 1.0%.

The recent vacancy rate data also shows positive signs for Melbourne, whose real estate market was hit the hardest following multiple significant lockdown measures. Melbourne’s vacancy rate had exceeded that of Sydney’s from September 2020 before hitting a peak of 4.7% in December 2020, but that has since trended downward, dropping sharply by 4 percentage points in April 2021.

Asking price data for May shows that sellers are pushing asking prices ever higher:

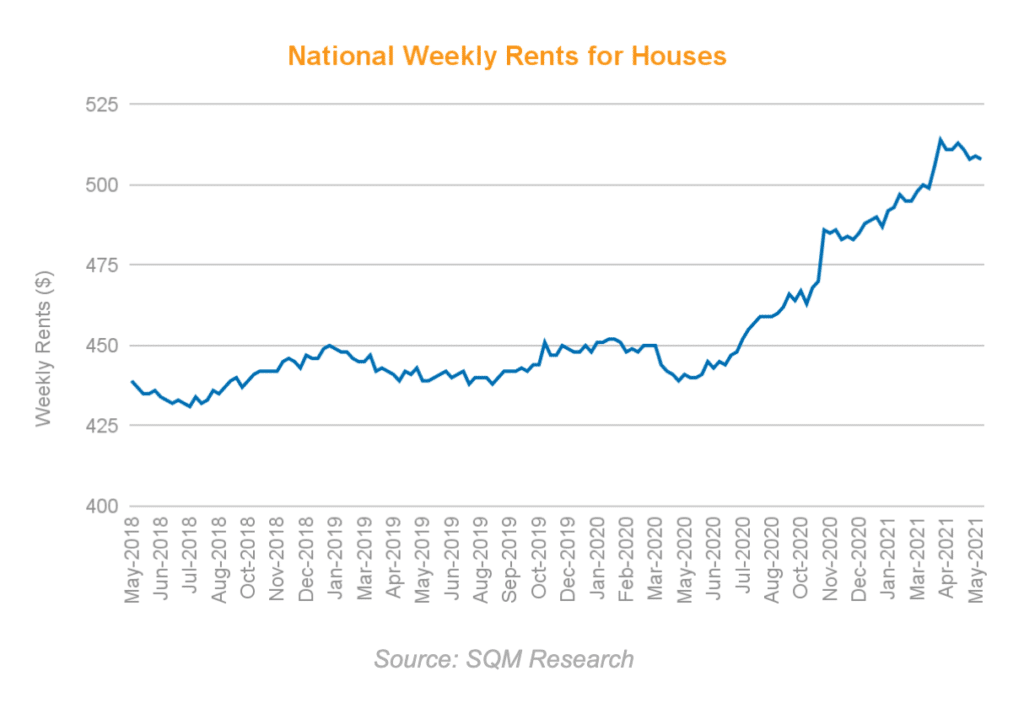

Weekly rent data also shows that asking rents have been climbing at a significant rate since April 2020. For investors more focused on cashflow opportunities, these higher yielding markets are offering attractive safe havens for profit.

With rents and property prices continuing to rise, it pays to know which areas will perform best over time. Many savvy investors are now looking to key macroeconomic data to understand and pinpoint hidden areas that will achieve above average returns as well as capital growth.

Freedom Property Investors utilise a team of full-time research analysts who closely monitor several key data points in order to easily identify areas of significant investment potential. Our members are able to benefit from these leading market insights and are able to take advantage of opportunities often unseen to the average investor.

To find out where you should be investing in this market, join one of our informative and FREE online Masterclasses where we cover the strategies we use to pick winning property, as well as how to pay off your mortgage in 10 years or less.