With current lenders offering some of the lowest rates ever, we should all be considering purchasing property or otherwise risk missing out on significant wealth creation in the future.

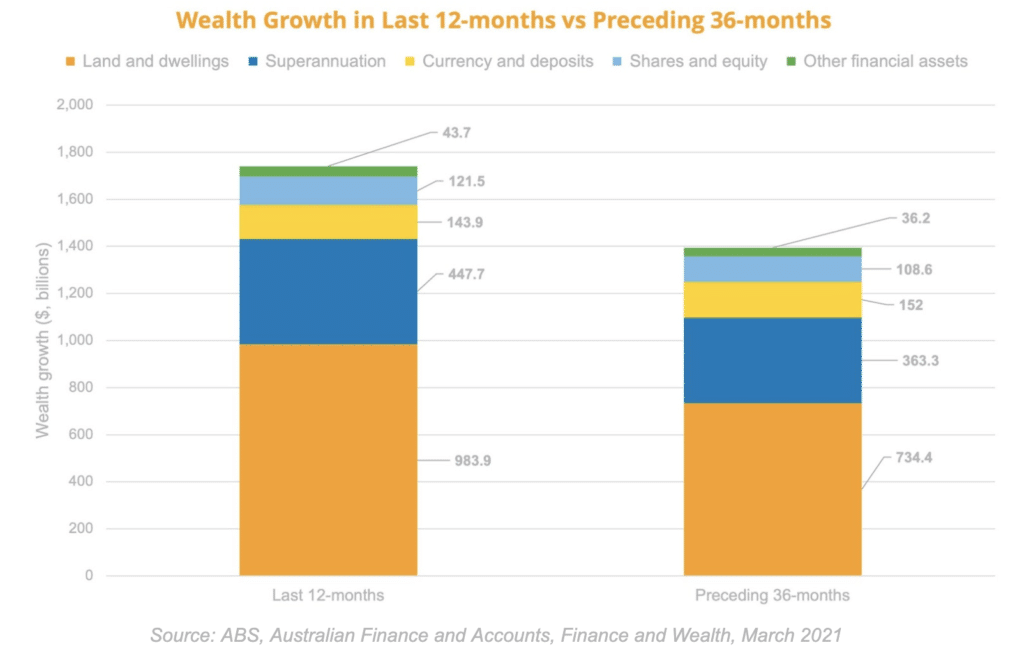

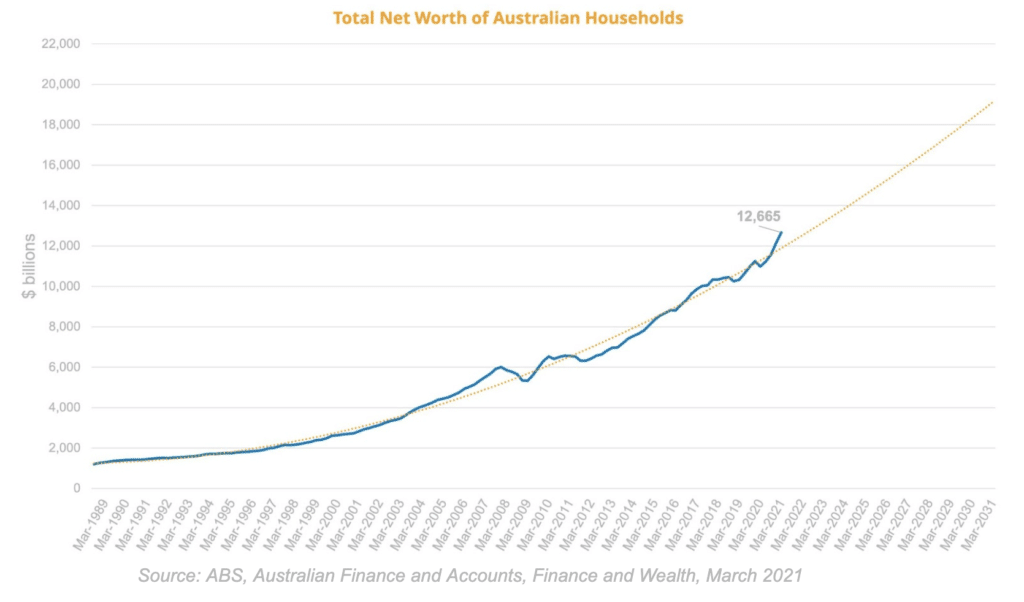

In the latest data from the Australian Bureau of Statistics, the wealth of Australian households rose $518 billion in the March quarter of 2021, reaching a record $12.664 trillion.

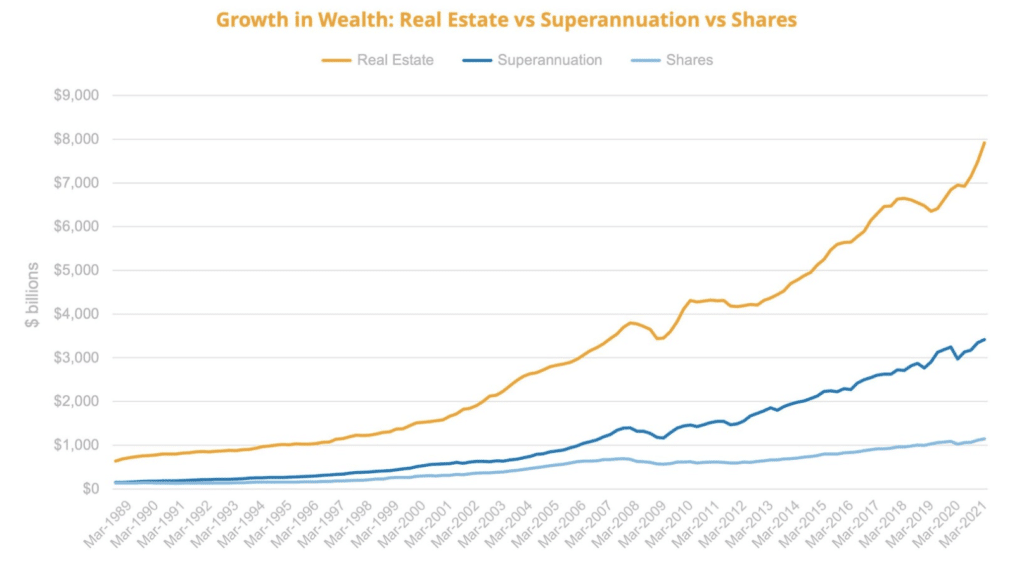

Property owners gained the majority of this wealth, over the likes of superannuation as well as shares and equity, as 84% of growth in the March quarter came directly from land and dwellings.

Coming in at a distant second place was superannuation, contributing to 15% of the March quarter growth, and in third place shares and equities contributed 5%.

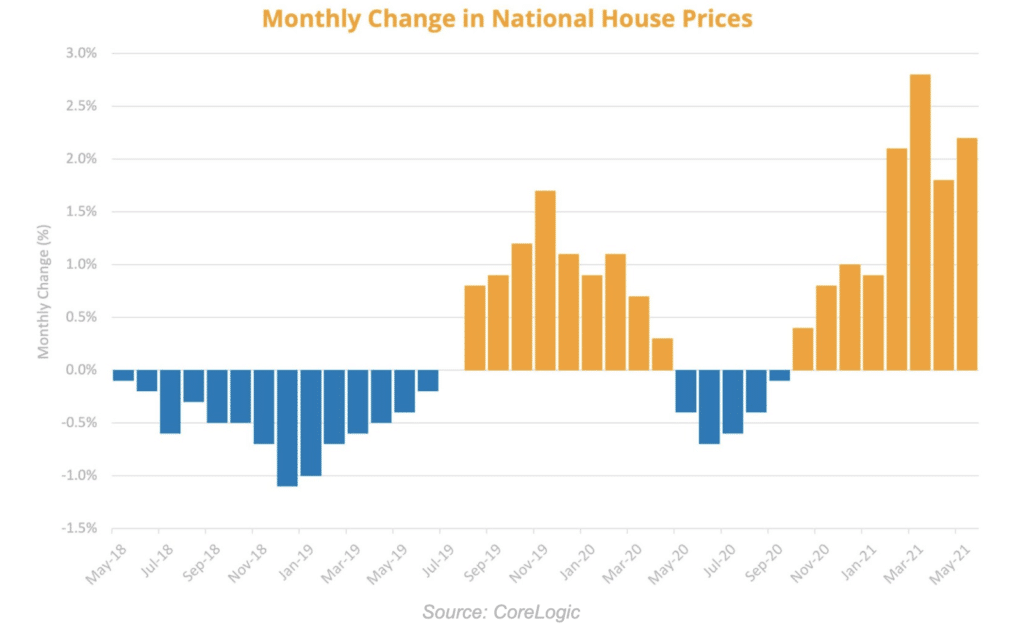

Those following the real estate market would know that we are currently experiencing one of the largest property booms in our history. From the final quarter of 2020, national house prices have been surging at an explosive pace, with the 2.8% growth in March 2021 setting a 32-year record.

Such is the extent of the booming real estate market that household wealth grew more in the last 12-months than it did in the preceding three years combined.

Real estate ownership has long been seen as one of the most stable and reliable sources of wealth, but how many Australians are currently controlling real estate?

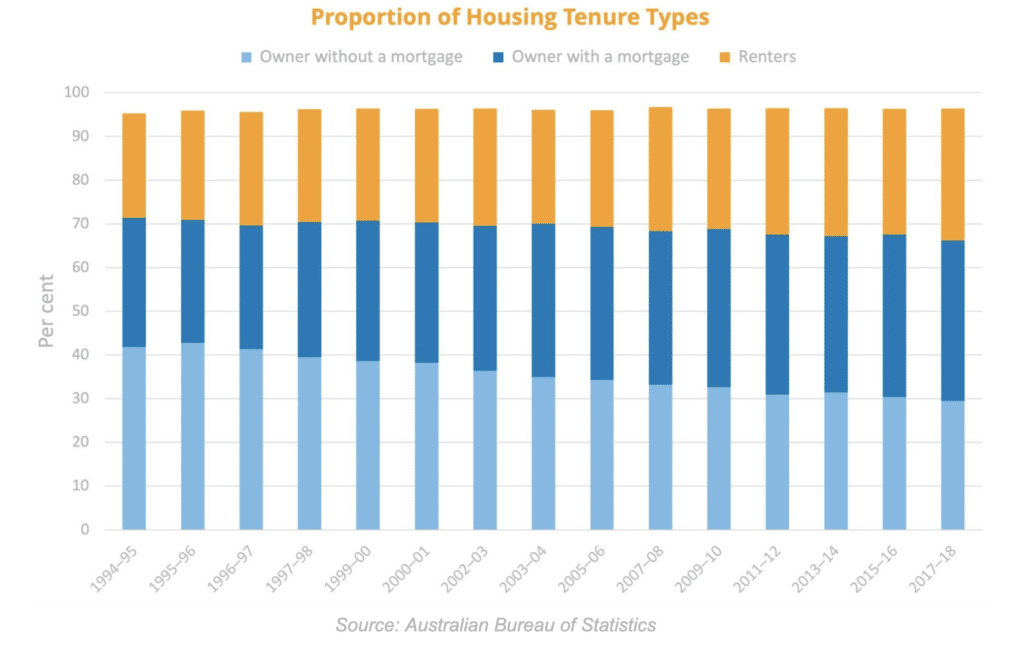

In the most recent home ownership data from the Australian Bureau of Statistics (covering the period up to FY18), the total proportion of homeowners in Australia (including owners with a mortgage and those without) is around 70% over the long term.

In the mid-1990s the proportion of homeowners was over 70%, but this figure has been trending lower and the proportion of homeowners in 2018 was recorded at 66.2%. Likewise, the proportion of renters has been increasing over this period, and recorded at 30.2% in 2018.

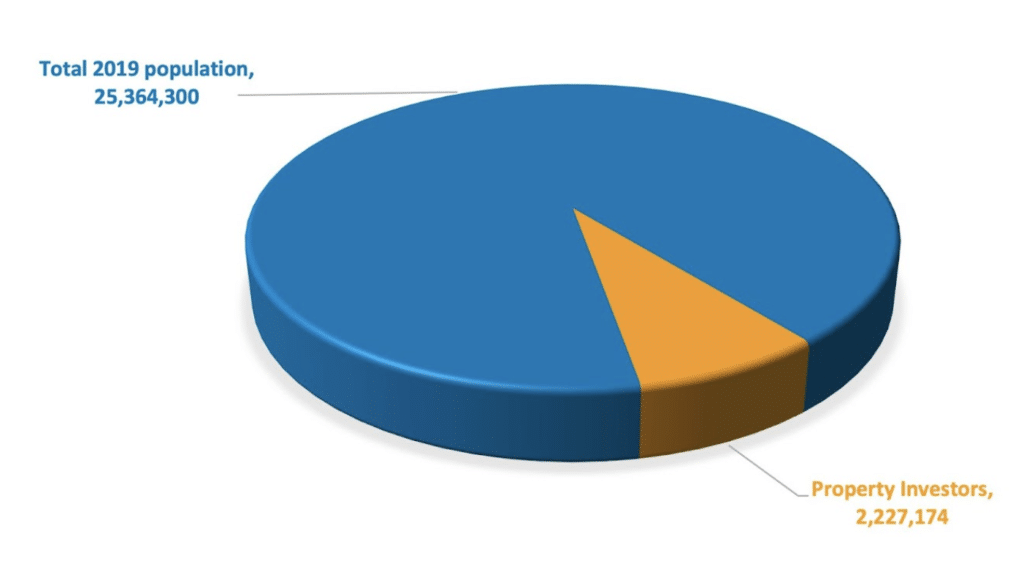

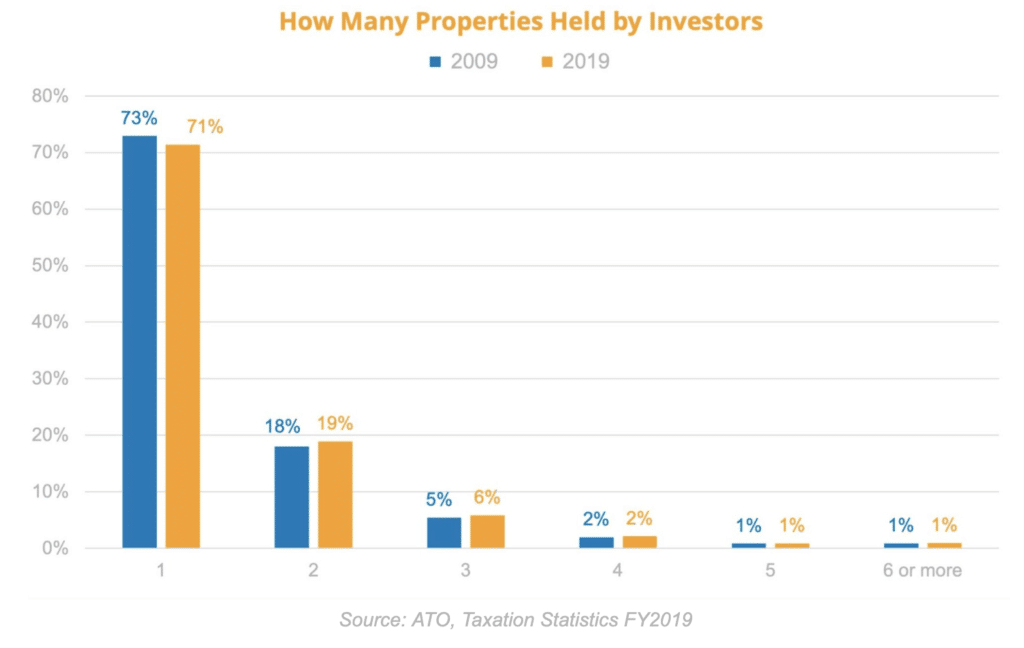

In terms of persons holding an investment property, the latest data from the Australian Tax Office (covering the period up to FY19) showed the number of property investors in 2019 was 2,227,174.

Using the 2019 Australian Estimated Resident Population (ERP) as a baseline, this proportion of property investors represented less than 9% of the population.

Within this group of property investors, 71% had at least one investment property, 19% had two investment properties, and for 3 or more investment properties the proportion becomes very small.

Interestingly, comparing the 2019 data to 2009 shows that the mix did not change much over the last 10 years. Most investors do not acquire more than one investment property, and even less will acquire more than two.

For those who have yet to take action to secure their share of the wealth creation happening in this country, take a look at the breakdown of wealth creation since 1989:

It is clear that, historically, Australians who are successfully increasing their wealth are doing so through the means of property investing. Looking forward, those who own multiple properties will be far better positioned for future wealth than those without a property.

With current lenders offering some of the lowest rates ever, we should all be considering purchasing property or otherwise risk missing out on significant wealth creation in the future.

With growth in net wealth continuing to increase, if you have been considering an investment property, or expanding your current portfolio, now is the time to act and secure your wealth both now and well into the future.

There are multiple drivers currently at play that are leading many of the major banks to predict sustained growth throughout the rest of 2021. In fact, when considering current macro-economic factors, the recent substantial rise in property prices is offering savvy investors with select areas of significant capital growth.

Sooner or later, the economic challenges due to COVID-19 will come to an end, and when that happens, those who had a plan and took advantage of these often unseen opportunities will be set to benefit enormously.

Over the last decade, Freedom Property Investors has developed a proven methodology for identifying profitable investment properties for our members.

Through rigorous research and a clear understanding of the main macro-economic forces that historically drive the property market, we are able to position our members toward areas of positive cashflow and high capital growth potential.

If you would like guidance on how to build wealth with a property portfolio, as well as learn how our data-driven property selection process can benefit your financial future, speak to us today.

Alternatively, you can join one of our free online Masterclasses and see exactly how we are helping thousands of Australians retire sooner and achieve financial freedom through property investing.

– Scott Kuru & Lianna Pan