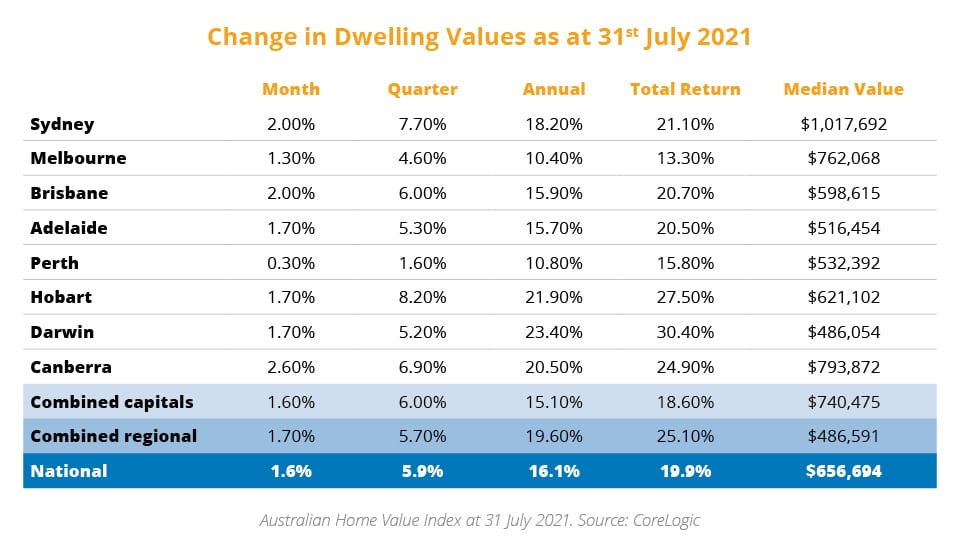

The prolonged cautionary measures in place in NSW and VIC appear to have had little impact on the property market, following an increase in national dwelling values again in July.

In the latest figures from CoreLogic, last month resulted in an annual dwelling value growth rate of 16.1 per cent – which is the fastest growth in 17 years.

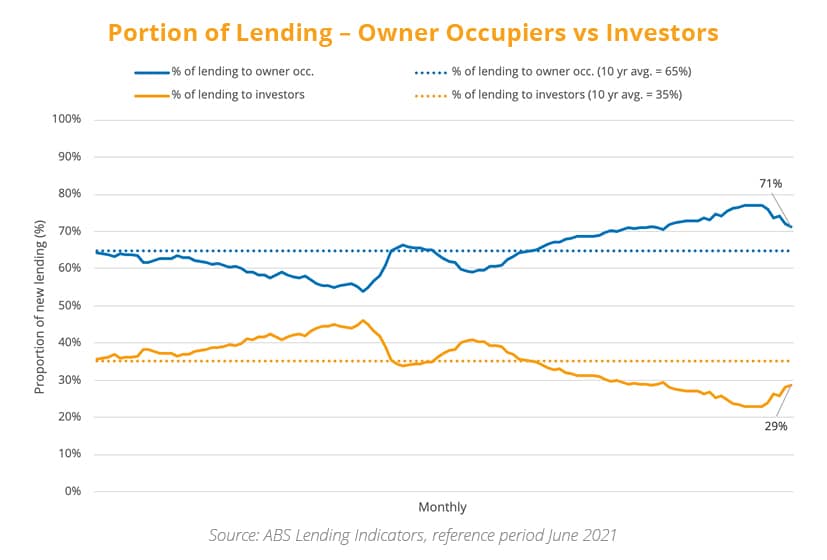

Based on the latest data for lending, there is still record-levels of new loan commitments with $32.049 billion in new loans (excluding refinance) in the month of June 2021, which is down only 1.6 per cent from the previous month of May 2021 which was record-high of $32.565 billion.

This suggests the real estate market still has plenty of momentum in this current growth phase. It is important to note that this current property boom is driven primarily by owner occupiers and not investors, like other previous property booms.

In June, data showed that the proportion of lending to owner occupiers was still remaining above the 10-year average at 71 per cent.

Until February 2021, the proportion of lending to investors had been on a decreasing trend since the end of 2016, so while there is a lot of talk in the media looking to blame investors for the current housing boom and the rising cost of housing, the reality is that the massive growth in recent months has been due to owner occupier demand.

The last time investor lending exceeded the average was back in 2013-2015 when the proportion of lending to investors reached a peak of 46 per cent share of the total lending. Since that point, lending to investors has been on a decreasing trend to reach a long-term minimum of 23 per cent between Sep-2020 and Jan-2021.

In the last few months, the investor share of lending has started to increase, reaching 29 percent, which is still below the 10-year average of 35 percent.

What does this mean for property investors?

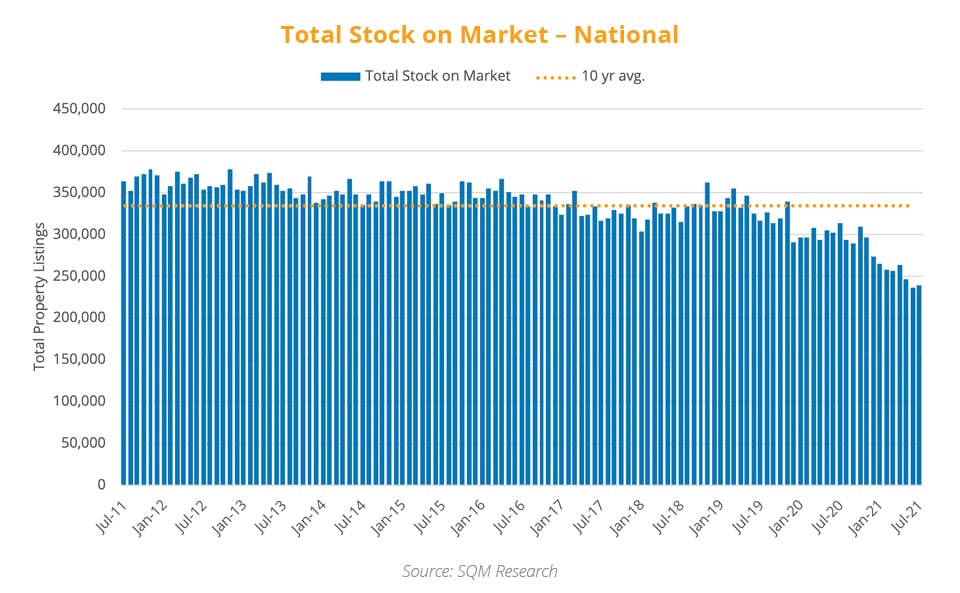

As it stands, the national property market is in a state of undersupply. Total stock on market is at a record-low, with the July data showing property listings at 238,834 nationally – 29 per cent below the 10-year average of 334,943 property listings per month.

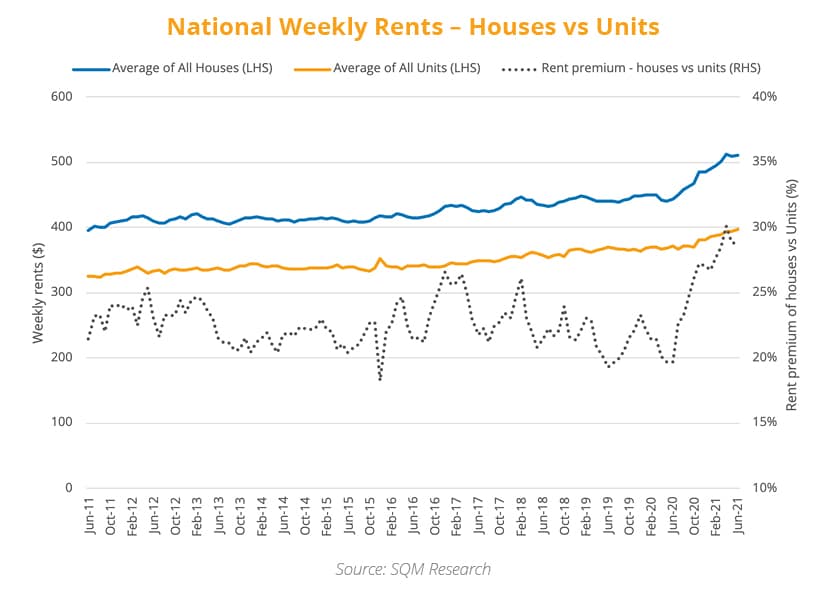

In the rental market, vacancy rates have been on a declining trend which started back in 2016, and the latest data for June recorded a national vacancy rate of 1.7 per cent, a level not seen since October 2011.

This shortage of rental housing is putting upwards pressure on rents, with the latest rental data for June recording a year-on-year surge of 15.0 per cent.

Average unit rents have also grown over the last 12 months, and although it has not grown as fast as the rents for houses, it has still increased by 6.9 per cent.

Interestingly, the gap between rents for houses vs units is the widest it has been for a 10-year period, with a rental premium of 29 per cent for houses over units, compared to the long-term average premium of 23 per cent.

This is likely to boost future demand for units, as better value options attract higher levels of demand.

Without a doubt the government stimulus and low interest rates have added a significant increase to the demand being experienced across the country. Additionally, the housing market has been in a state of undersupply in most parts of Australia, even well before the start of the pandemic.

Whilst the current property market boom is largely attributed to owner occupier demand, due to low vacancy rates and rising rents, we will likely see increasing interest from investors looking to gain from favourable future outlooks.

The question then remains is where should investors be looking to reap the rewards of the current housing boom and projected future growth.

Join our regular and free online Masterclass detailing the key indicators investors need to be aware of before purchasing. We also cover the exact areas you should be looking at which are going to profit the most in the months and years ahead.

This information is vitally important to anyone considering entering the market in 2021 and beyond.

– Scott Kuru & Lianna Pan