Australia’s property boom has slowed, but it certainly isn’t over.

The economic rebound that has propelled the housing market over the last 12 months could be about to enter a renewed growth cycle, with Westpac recently predicting another year of growth ahead in 2022.

As borders are set to reopen and a flood of new migrants able to enter the country, many regions are now facing a rental crisis where supply isn’t enough to satisfy demand.

Our capital cities may feel this effect more so than regional areas, with almost all cities expected to see strong upward rental pressures in the coming months due to the shortage in available properties.

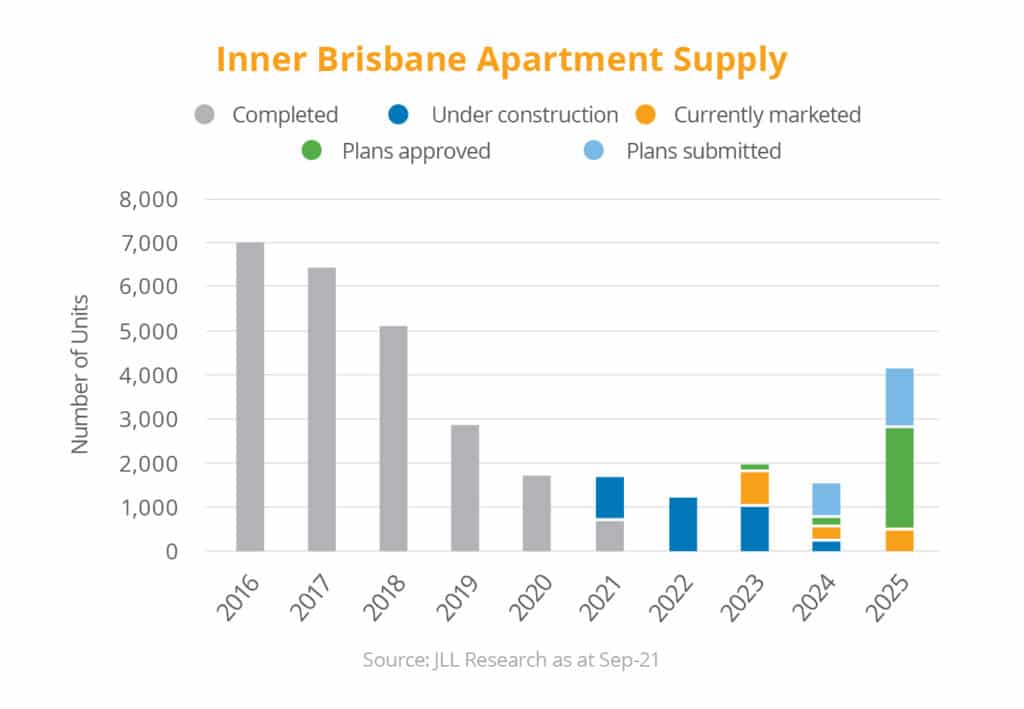

Many areas are already experiencing falling or below average vacancy rates which will soon be accelerated through border reopenings. Brisbane could be one of the hardest hit, particularly where current supply levels still remain low in comparison to previous years.

For example, the total number of completed new apartments in Inner Brisbane is currently sitting around 700 for the year-to-date. A further 1,000 apartments are still anticipated to be completed in 2021, which would bring annual completions to just over 1,700 units.

While this may seem like a reasonable figure, it is still well below the level of 2020 and even less than a quarter of the peak reached in 2016. What this means is that prospective tenants in these already populated areas will soon be facing greater competition, with fewer properties to choose from.

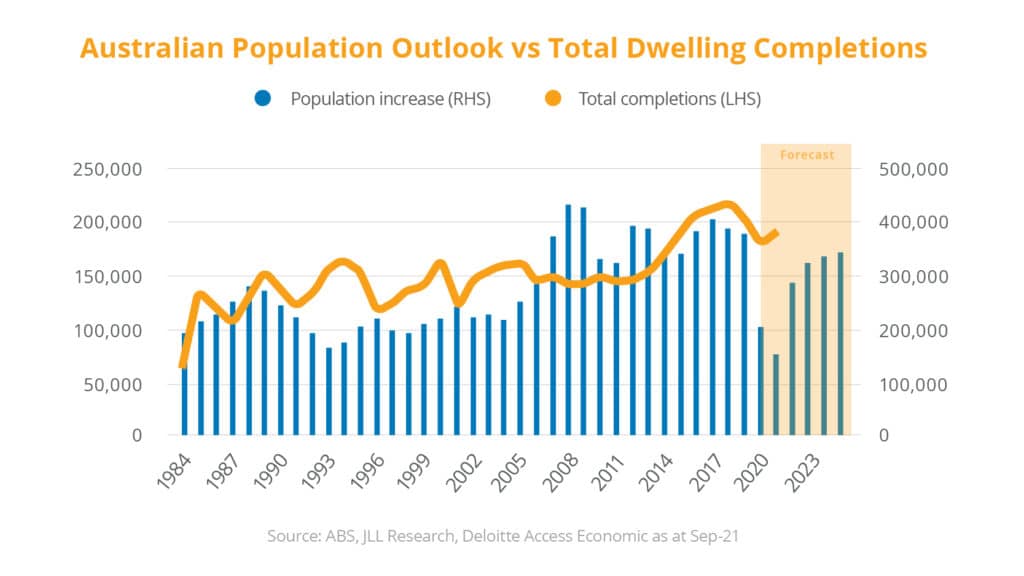

Throughout the COVID-19 pandemic we saw high levels of interstate migration which has helped fuel demand for property. With international borders reopening, population growth across the country is anticipated to increase along with greater demand.

In the months ahead, increased demand will be met with low levels of new supply which will likely see vacancy rates fall further and, in turn, will intensify rental growth.

Obviously, this comes as great news to investors. In fact, investor demand is also expected to increase, supported by strong fundamentals such as low interest rates and highly attractive investment yields.

Areas with attractive cash flow due to increasing rents will provide new opportunities for investors who are looking to build passive income.

If you would like to learn more about how our data-driven approach to property investing maximises your investment cash flow, please speak to our friendly team of experts today.

– Scott Kuru & Lianna Pan