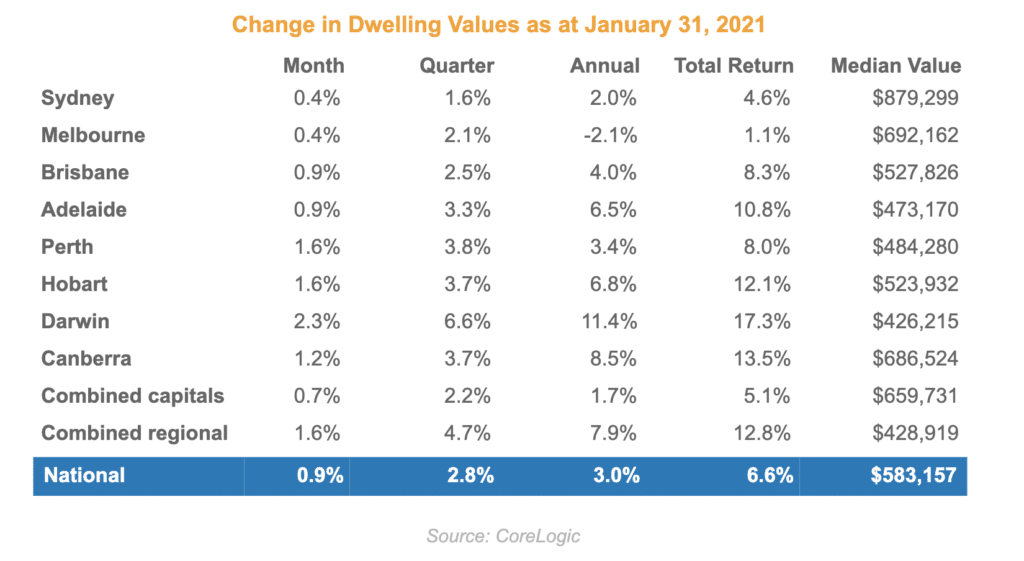

In the latest housing market data, housing values rose 0.9% in the month of January 2021, taking Australian home values to a record high, surpassing pre-COVID levels by 1.0%.

Once again, regional markets continued their trend of outperforming capital city markets – a trend which started with the onset of COVID-19 in 2020.

At a national level, the regional markets grew at over double the pace of the capital city markets.

In some states, the difference in growth rates between capital cities and regional markets is wider. For example, in NSW and VIC, the regional markets in these states grew at three times the pace of their capital cities.

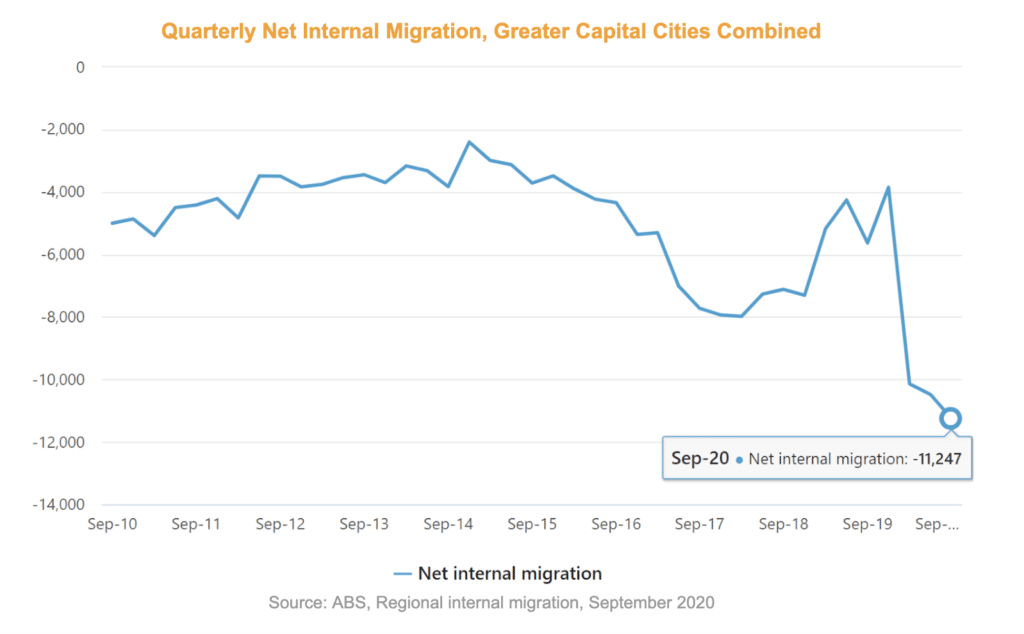

One of the key drivers of this phenomenon is the shift in interstate migration following the onset of COVID-19. In the latest data from the ABS, there was a net loss of -11,200 people from Australia’s capital cities into the regional areas in the September 2020 quarter.

This was a larger net loss than in the previous quarter (-10,484 in June 2020), and the September quarter of the previous year in 2019 (-5,600).

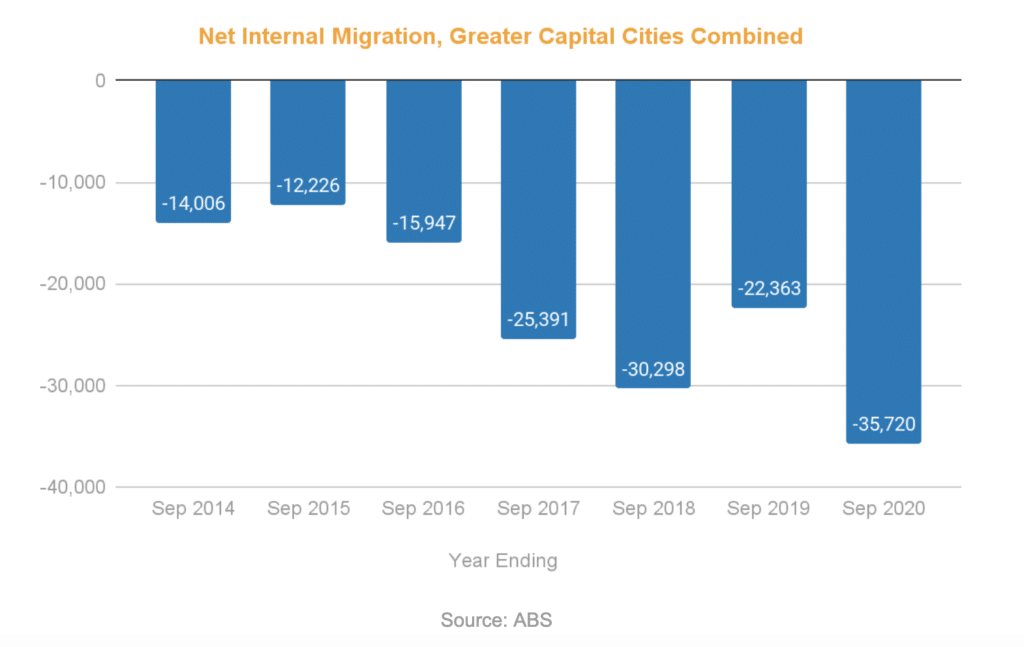

Looking at the figures with a yearly perspective, there was a net loss from the Australian capital cities of -35,720 people in the year ending September 2020, which is an increase in losses of -13,367 compared to the previous year ending September 2019.

While the latest ABS data only shows us until September 2020, this trend is likely continuing at present, and will likely continue into the short term future.

Because population growth is a driver of demand, this shift in the interstate migration trend will likely raise demand levels in the regional markets above historical levels.

Combined with the fact that many of these regional markets have historically low levels of supply (as evidenced by historical low vacancy rates and consistent price growth), explains why house prices in regional markets are outperforming the national average.

In order to capitalise on the opportunity presented by this shifting of demand, it pays to understand the trends at a deeper level and build an appropriate strategy.

At Freedom Property Investors, we study the entire property market and analyse a broad range of factors that drive supply and demand, in order to position our members in high performing areas.

If you would like guidance on how our data-driven property selection process can benefit your financial future, speak to us today. Alternatively, you can join one of our free online Masterclasses and see exactly how we are helping thousands of Australians retire sooner and achieve financial freedom through property investing.

– Scott Kuru & Lianna Pan