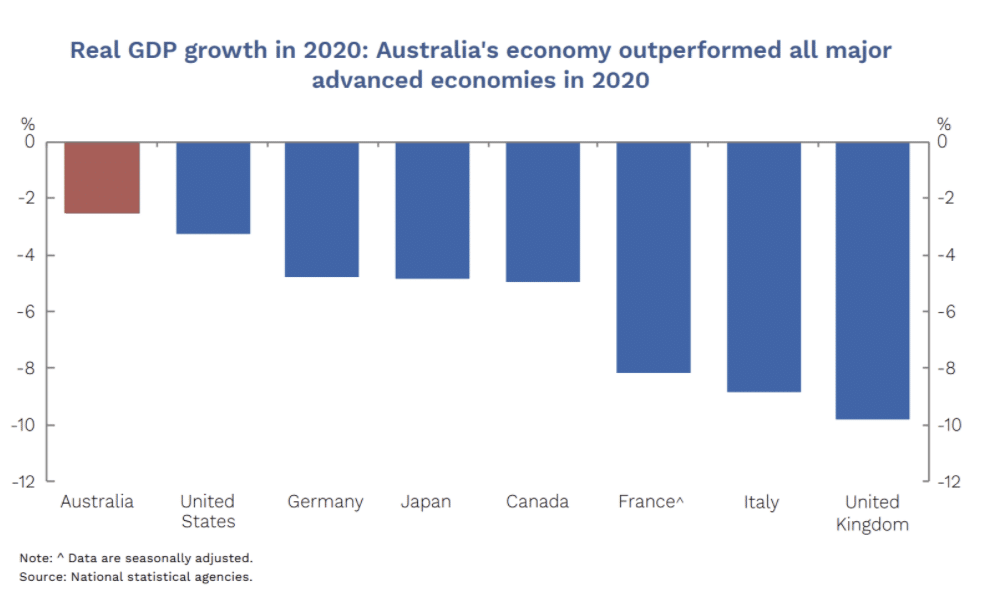

Despite the largest contraction in global economic activity since the Great Depression of 1930, Australia’s economy is in far better condition than most other countries around the world thanks to the effective management of the COVID-19 health crisis. The recently released 2021-22 Federal Budget looks to build on this success and further secure Australia’s economic recovery.

With tight quarantine controls and $291 billion in emergency economic support, the health of both the population and the economy were protected throughout 2020.

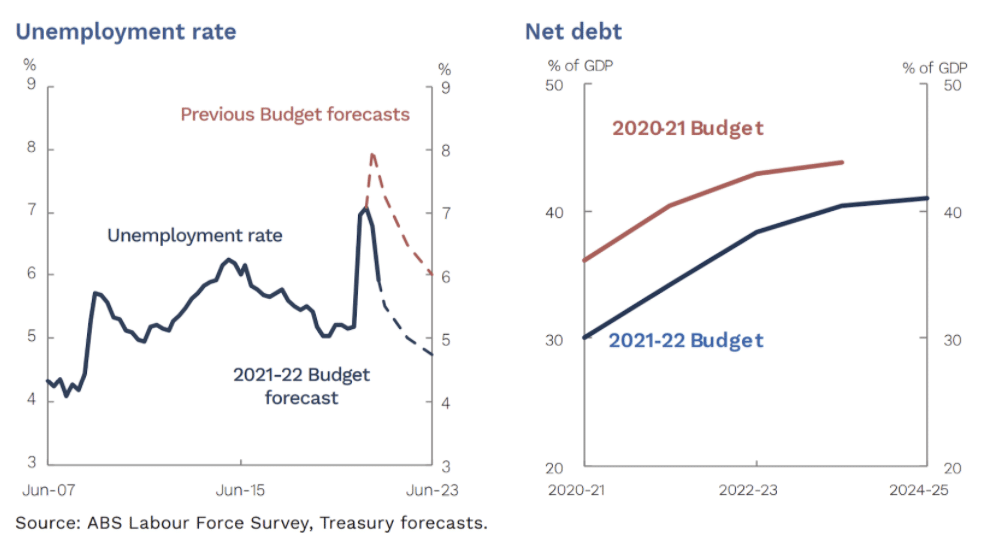

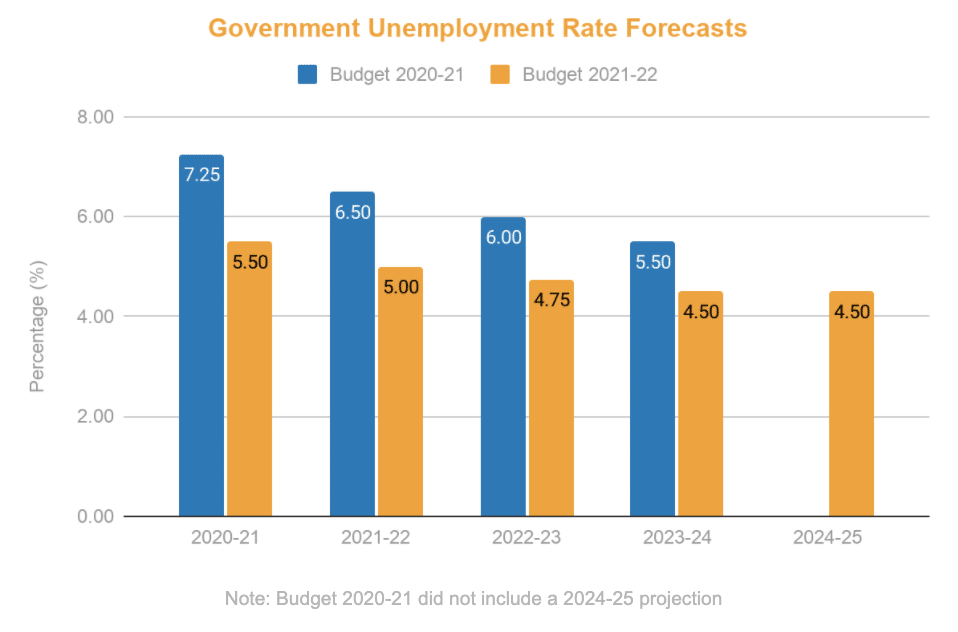

In fact, Australia’s economic resilience exceeded even the government’s forecasts, with the unemployment rate hitting a peak of only around 7% in July 2020, before dropping sharply to 5.6% by March 2021 as confirmed by the ABS. Compare this with the then anticipated 8% peak unemployment rate predicted by the Treasury in the previous budget forecast.

The Australian economy over the second half of 2020 rebounded at its fastest pace on record, with the unemployment rate now set to recover five times faster than the last recession of the 1990s. Additionally, net debt as a share of the economy will peak at a lower level compared to what was expected in the previous budget, easing the pressure on budget recovery in the future.

Freedom Property Investors had anticipated much of what is now occurring at large and have been able to position our investor community to capitalise on rapid and stable growth in key markets across Australia. Actuary and Data Scientist, Lianna Pan, highlighted in 2020 the government’s ability to quickly and effectively stimulate the economy and property market through the stimulus packages that we are now seeing.

In addition to this, Lianna had noted during the early onset of the 2020 health crisis that the government would use immigration to help boost the economy once borders reopened. This is not the first time the government has implemented such measures.

In the wake of the 2008 Global Financial Crisis, the Australian government increased the immigration quota which resulted in more than 400,000 new residents arriving in the country. This, as we know, led to one of the most profitable periods in the Australian property market, topped only by the recent 32-year record surge in house prices.

The Australian Treasury is now indicating that they intend to commence the gradual return of temporary and permanent residents as early as mid-2022. You can read more about Lianna’s predictions for the housing market by clicking here.

With the 2021-22 budget, the federal government looks to transition from broad-based support for the economy to a more targeted approach. This budget aims to boost job creation and workforce participation with key initiatives including:

- $20.7bn in business investment incentives – with a single year extension (to June 2023) of full expensing provision of new business investment

- $17.7bn for aged care – to be provided over 5 years, creating 33,800 more jobs in this sector

- $7.8bn in tax relief for low and middle-income earners – worth up to $1,080 to those with incomes between $37,000 and $126,000

- $1.7bn for childcare – with subsidies to encourage greater workforce participation

- $15.2bn on infrastructure – which when added to their existing 10-year infrastructure pipeline brings a record $110 billion of spending on infrastructure

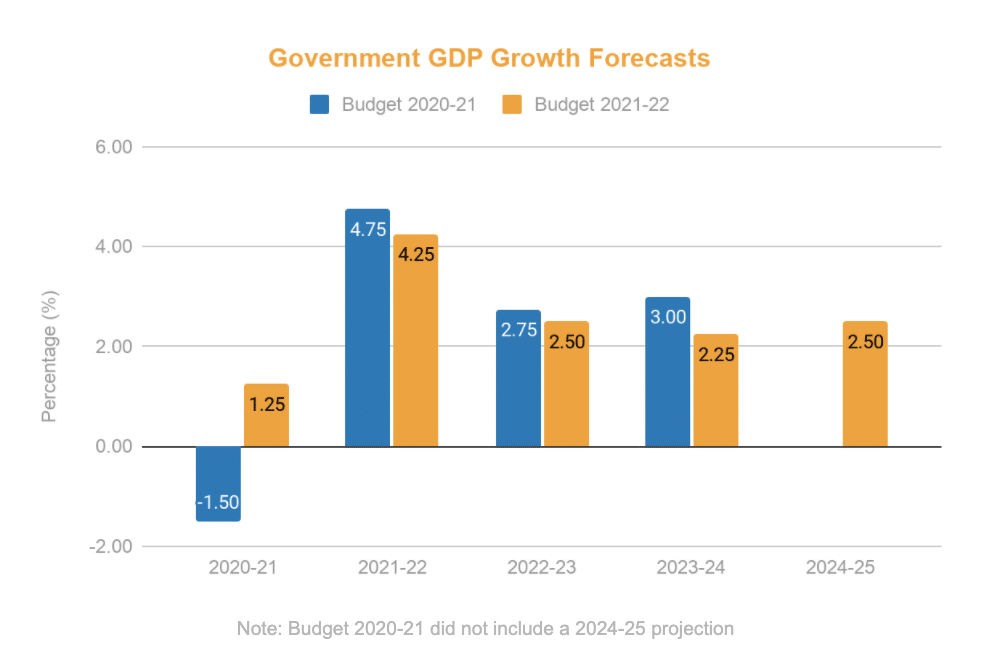

This is good news for job seekers, with economic growth in 2021-22 expected to reach 4.25%. Combined with significant government spending and tax cuts, the unemployment rate is expected to drop to 5.0% by the end of the financial year.

The budget also contains measures that will impact the property market, with a number of schemes that benefit property buyers:

First Home Loan Deposit Scheme

The government is adding an additional 10,000 places to this scheme in 2021-22. Under the scheme, a first home buyer will be able to purchase a home with only a 5% deposit, with the government acting as guarantor for 15%.

This will allow the buyer to take on a mortgage with a 95% loan-to-value ratio without paying lenders mortgage insurance (LMI).

The idea behind this scheme is to help first home buyers enter the market sooner, as rising house prices can exceed a person’s ability to save for a deposit.

First Home Super Saver Scheme

This scheme, which was first introduced in the 2017-18 budget, has been expanded to allow eligible first home buyers to use up to $50,000 from their superannuation to purchase a home.

With the concessional tax treatment of superannuation, it is possible for buyers to save money for the deposit more quickly by making extra contributions into their super fund, seen as a better place to have for a deposit since super funds generally return around 7% (compared to bank savings accounts returning around 1%). This scheme will begin on 1 July 2022.

Family Home Guarantee

Under this guarantee, eligible single parents will be able to build a new home or purchase an existing home with a deposit of 2%. The buyer must still meet serviceability requirements.

Extending Access to the Downsizer Contribution

From 1 July 2022, the minimum age for the downsizer contribution will be lowered from 65 to 60, allowing Australians nearing retirement to make a post-tax contribution of up to $300,000 per person when they sell their family home.

This means those who are 60 and over can sell a large family home, buy a smaller one and contribute $300k each into their super fund.

With the current state of the housing market and the general lack of supply, these budget measures which, in effect, increase the demand-side by bringing more buyers to the market, may put further upwards pressure on house prices.

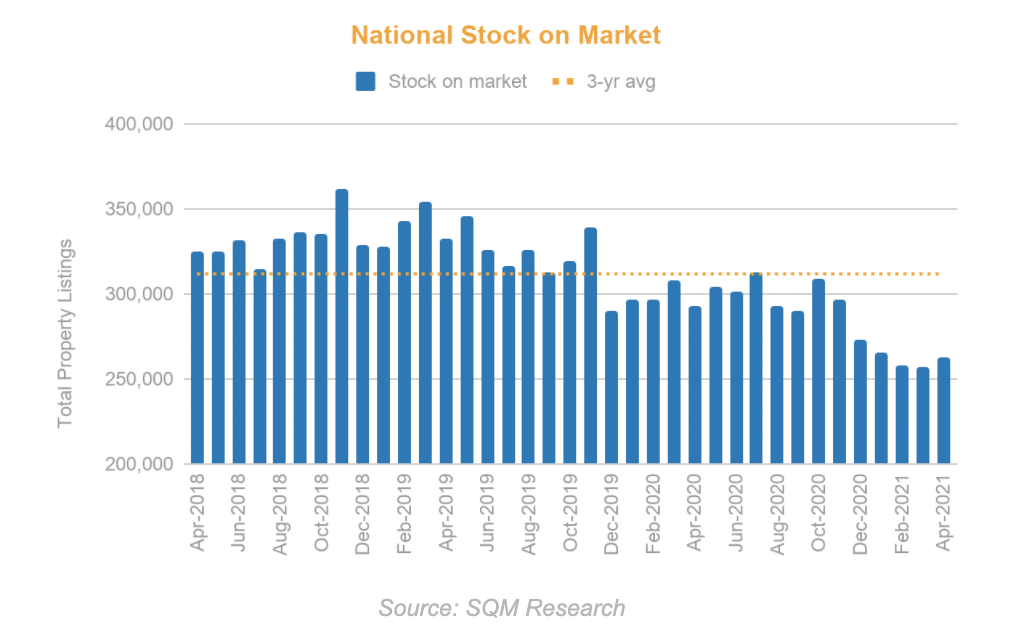

The current housing stock is at a level that is well below the long term average:

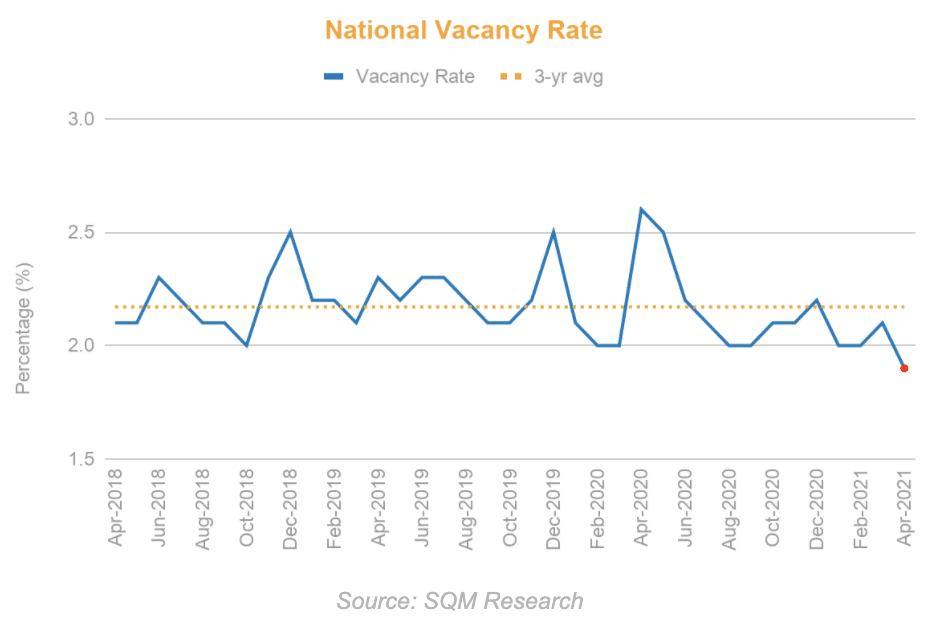

It is clear that across most parts of the country there still remains a shortage of housing, with rental vacancy rates in most capital cities below their one-year average. Last month the national vacancy rate dropped to 1.9%, a level not seen since March 2013.

With a combination of historically low interest rates, low housing stock levels, and an economy in a V-shaped recovery, the real estate market looks set to continue on a strong growth trajectory. Consequently, this has led the big-four banks to predict further house price growth of 15%-20% over 2021 and 2022.

For those who are already actively investing in property, or who may be considering their first investment, now is the time to capitalise and plan your path to financial stability. Many of our members have already experienced exponential growth thanks to our key data insights and strict 13-point investment selection criteria.

With some of the largest banks in the country predicting further growth in the year ahead, it is important that investors arm themselves with the right knowledge and strategy in order to pinpoint suburbs that will perform better than others.

Freedom Property Investors have identified numerous regions across the country which are set to benefit enormously from this Federal Budget. To find out where these areas are and why the time to invest is now, get in touch with us today or attend our free online Masterclass.

A full overview of the Federal Budget 2021-22 can be found here.